For those with long-term goals spanning 5–10 years, now is the time to consider investing in gold. Compared to other types of investments, gold has lower risk while still providing returns and peace of mind. Once you invest in gold, it is recommended to monitor global gold prices. For those wondering how ANTAM LM gold prices are determined, one key factor is global gold price movements converted into Indonesian Rupiah.

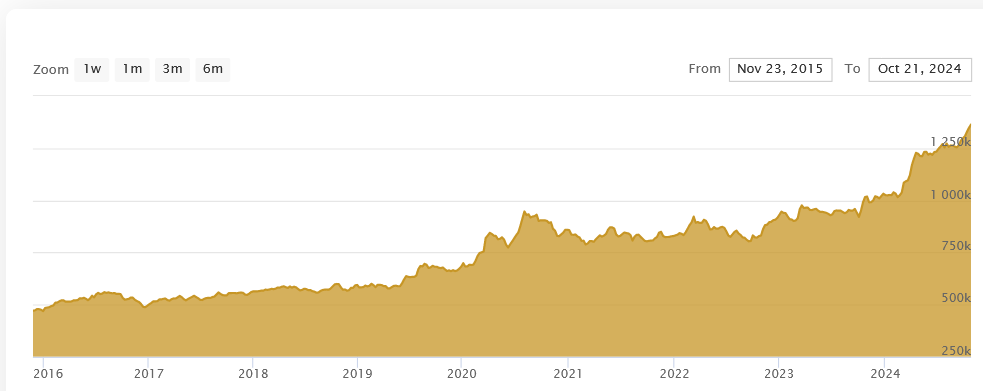

As shown in the chart above from ANTAM LM’s official website (www.logammulia.com), gold prices have generally increased from 2015 to 2024. Gold price movements are fluctuating and influenced by several factors. Let’s explore them.

One factor affecting global gold prices is uncertainty in the global situation. This includes economic conditions, geopolitics, wars, and economic recessions. In unstable economic conditions (due to war, political instability, or recession), market sentiment shifts toward risk aversion, and investors often move their portfolios to safe-haven assets like gold.

Unlike currencies, which may weaken during instability, gold tends to increase in value under uncertain political and economic conditions. This is why gold is considered a safe-haven asset—able to protect wealth with minimal risk.

The upward trend in gold prices is also influenced by predictions of a global economic recession due to the COVID-19 pandemic and the Russia–Ukraine war.

Another factor influencing gold price fluctuations is the supply and demand of gold. As with other commodities, the law of supply and demand applies. Prices rise when demand increases, and fall when supply exceeds demand.

However, unlike currencies, gold remains relatively stable even when supply increases, as gold is not only used for investment but also for jewelry and components in electronics and other industries.

Monetary policy from the US Federal Reserve (The Fed) also affects gold prices. Specifically, decisions to raise or lower interest rates influence gold. When the Fed lowers rates, gold prices usually rise because a lower interest rate makes the US dollar less attractive, encouraging investors to buy gold to preserve wealth.

Inflation can also influence gold prices. Inflation reduces the value of currency, affecting the purchasing power of savings. For this reason, many investors choose gold as a more stable store of value compared to fiat currency.

The USD exchange rate is another indicator for global gold prices. When converting global gold prices into Indonesian Rupiah, a weaker Rupiah relative to the USD strengthens domestic gold prices, while a stronger Rupiah lowers them.